The appetite for binge-worthy video content has become one of the fastest growing phenomena in the sphere of digital advertising.

It’s the main reason why consumers weren’t so chill about Netflix’s announcing their intention of adding an ad-based tier. Although HBO Max, Hulu, Paramount+, and Peacock had already implemented their ad supported subscription tiers in 2021.

With cord-cutting being the norm, Connected TV (CTV) is becoming a ubiquitous part of everyday life. In fact, 87% of all American households own at least one CTV device, a dramatic increase compared to just 38% ownership in 2012.

CTV is widely adopted across all age groups, but is most popular amongst 18-34 year olds, making this engaged audience an exciting opportunity for advertisers.

In this guide, we’re going to cover everything you need to know about the world of CTV. Whether you’re an advertiser, streaming services provider, or a publisher (or just a curious reader), you’ll get a full understanding of what connected TV is, how the ecosystem works, and how to succeed in advertising within its ecosphere.

Let’s get right into it.

What is connected TV?

Connected TV, or CTV for short, is a TV device that connects to the Internet and allows viewers to watch video content.

CTV devices include everything from Smart TVs with integrated wifi and streaming, to gaming consoles like Xbox or Playstation, as well as streaming devices like Apple TV, Google Chromecast, Amazon Fire TV Stick, and Roku.

CTV ad spend is expected to grow by 33.1% and reach $18.9 billion this year in the US, with CTV expected to take more than two-thirds of the market in terms of upfront digital video spending in the US this year.

So while linear TV advertising budgets are still slated to reach $68 billion by the end of 2022, the gap is closing faster than ever before.

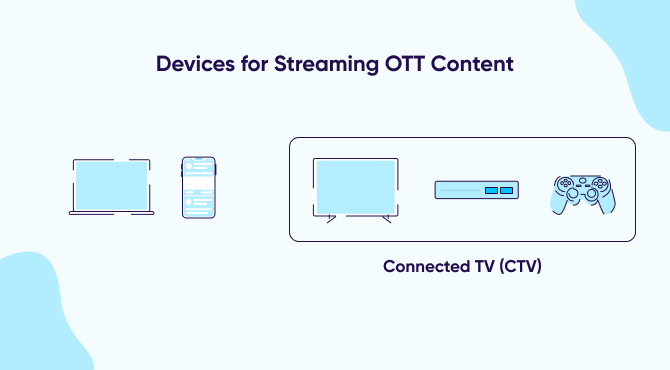

What’s the difference between CTV & OTT?

Before we get into the weeds of CTV, let’s clear the air about a common mistake with terminology. Marketers oftentimes (incorrectly) use CTV and OTT interchangeably, but the two terms are vastly different.

Bypassing traditional cable, satellite, and broadcast TV, over-the-top providers (OTTs) provide premium video content via dedicated apps or sites.

To put it simply, OTT content is viewed using CTV devices. Some of the most popular OTT services include:

- Netflix

- Disney+

- Hulu

- ESPN+

- Amazon Prime Video

- HBO Max

- Apple TV+

- CBS All Access

- YouTube TV

- Starz

- Pluto TV

- Sling TV

- Tubi

- Fubo TV

- Peacock TV

- Vudu TV

- Crackle TV

- Kanopy TV

What does the CTV ecosystem look like?

With the distinction between CTV and OTT out of the way, let’s talk about the ecosystem. Succinctly put, data is the center of it all, and technology companies are fighting for valuable advertising space in the CTV ecosystem.

TV operating systems that enable streaming collect rich data for advertisers to capitalize on, resulting in the physical production of TVs becoming secondary to OS adoption. This ultimately is driving the costs of TVs down.

While Samsung and LG are the first and second largest physical TV manufacturers, their operating systems only own 14% and 7% of the market share respectively, while in the US, Roku and Amazon Fire TV together hold about the same 60% market share as all smart TVs combined — in an extremely fragmented environment.

This has led to a competitive race for higher OS adoption across smart TVs, streaming devices, and gaming consoles.

Amazon has their Amazon Fire TV line with Alexa, Fire OS, and Prime Video distribution embedded out of the box, while LG, Samsung, Vizio, and other smart TV manufacturers battle it out for dominance in our households.

The fragmented components of CTV – and how it impacts advertisers

There are no less than eight major sub-segments in the CTV ecosystem:

- Broadcasters provide exclusive streaming content (Hulu, Disney+, Netflix).

- CTV-enablement devices offer TV streaming (Roku, Amazon Fire TV Stick).

- Smart TV devices have streaming capabilities (Samsung TV, LG TV, TCL TV).

- Mobile Measurement Partners (MMPs) accurately measure campaign performance and combat fraud.

- Supply-side platforms (SSPs) are software solutions that manage the advertising exchange from the publisher’s side — including selling ad space, optimizing deals, and measuring campaign performance.

- Demand-side platforms (DSPs) are programmatic tools that mediate ad buys and provide inventory in a single interface. DSPs also serve advertisers to purchase ad impressions for the lowest CPM.

- Advertisers that are purchasing ads.

Publishers and networks that sell advertising inventory and include players from above categories such as smart TV device manufacturers (e.g. Samsung Ads, Vizio Ads)

Every inventory source collects data differently, resulting in different insights. Pixels can be used by some providers, which allow for more accurate measurement and engagement.

Often, inventory sources operate in walled gardens, which force advertisers to work directly with them, deal with varying and limited data sets, and prevent user-level data from leaving their individual platforms.

The result? An extremely competitive and fragmented marketplace — that makes it increasingly challenging for advertisers to accurately measure their campaigns across various devices and platforms.

CTV & OTT monetization models

Now that we’ve covered how CTV and OTT works, let’s talk about money. There are four primary monetization models that you should know about.

1 – Subscription Video on Demand (SVOD)

The most widely utilized model, Subscription Video on Demand requires users to pay a monthly or annual subscription fee for unlimited access to content.

This is the model Netflix, Amazon Prime, and Disney+ utilize today, and requires OTT providers to be the home to regularly updated exclusive content — in order to build a loyal viewer base.

2 – Advertising-Based Video on Demand (AVOD)

This model utilizes strategic pre-roll, mid-roll, or post-roll ads stitched into the video content. Publishers could also utilize banner ads, sponsorships, and paid placements to fund their business — instead of relying on recurring subscription fees.

Xumo and Crackle are two platforms that are currently utilizing the AVOD model.

3 – Transactional Video on Demand (TVOD)

This new and emerging monetization model focuses on generating revenue from one-off pieces of content by charging for single episodes, films, or pay-per-view events.

Instead of relying on building a loyal and constantly returning audience, the TVOD model focuses on providing premium and hyper-exclusive content that cannot be found elsewhere.

4 – Hybrid model

Streaming services of all shapes and sizes are experimenting with more revenue models than ever before, and many are utilizing a hybrid model, which is a mix of two or more monetization models.

For example, Hulu offers a baseline ad-supported plan, a non-ad plan, and a bundle that comes with Disney +, ESPN+, and Live TV.

CTV-to-CTV attribution and measurement

As discussed previously, CTV viewership is soaring, which makes it the perfect solution for user acquisition. Programmatic engagement allows for highly specific applications of 1st and 3rd party data, making it possible to reach the vast majority of audiences.

CTV-to-CTV attribution is defined as same-device, same-OS attribution of CTV ads that result in CTV app installs. We recommend working with an MMP that integrates directly with CTV platforms like Roku, Fire TV, Apple TV, Android TV, Chromecast, gaming consoles, and smart TVs — to ensure you can harness deeper metrics such as LTV and metadata for better attribution.

It’s important to note that each CTV platform provides its own reporting method, and the reporting itself may vary in terms of consistency, granularity, and data nomenclature.

That’s why it’s critical to partner with an MMP that provides centralized, unbiased attribution across multiple media sources, channels, and devices — consolidated in a single dashboard.

What are the benefits of connected TV for advertisers?

There is no question that the CTV space is growing faster than ever before. While the market is heading towards maturity, there is still tremendous room for growth. Here are a few of the key benefits CTV presents for advertisers:

Segment like never before

Unlike traditional TV, the CTV space allows advertisers to reach out to audiences based on their demographics, interests, context, time of day, device, and geography.

In comparison, traditional television heavily relied on estimates from third parties such as Comscore and Nielsen that were sometimes unreliable and often an informed guess at best.

With OTT content viewership on a meteoric rise, the audiences garnered in the CTV space are extremely engaged and valuable to advertisers, which is why smart segmentation is key to success in this medium.

Brand safety

Advertisers have much more control over where their ads are being shown — at scale. The combination of more specific engagement with improved ad buying systems allow advertisers to show their ads at the right place and at the right time, minimizing any room for mishaps or irrelevant ad placements

Cross-device measurement and engagement

CTV allows advertisers to measure their ad campaign performance across devices based on the wealth of data collected. With cross-device data, they can measure ROAS, understand what’s working, and optimize future campaigns based on past lessons.

Advertisers can also create contextual customer experiences leveraging deep linking technology. By placing links and QR codes powered by deep links, brands can run mobile app campaigns on CTV that bring users to the right content in their apps.

Crafting smooth journeys using deep links is a powerful and relatively straightforward path that leads to happy customers, increased revenues, and return on experience (ROX).

How does CTV-to-mobile attribution work?

One cross-device flow worth mentioning is CTV-to-mobile, where mobile app marketers buy media on CTV in order to drive growth and engagement for their mobile app.

Whether the integration is done via SDK or API, MMPs ensure app installs and post-install events are accurately measured.

For example, with CTV-to-mobile attribution, marketers can understand that a mobile app installed after seeing an advertisement on a CTV device — should be attributed to CTV.

CTV’s biggest pitfall: spoofing and ad fraud

With 60% of advertisers in the US moving from linear TV to CTV and OTT, the explosive growth placed a spotlight for fraudsters to pounce. The lack of safety nets and regulation presented an opportunity for ad fraud operations like Octobot, SneakTerra, and Smokescreen that siphoned $6M per month.

Fraud usually comes in three forms:

- Device spoofing: impersonation of another computer system (non-human bot traffic).

- Multiple device spoofing: pretending to be watching on multiple devices.

- SDK hacking: where the fraudster intercepts the SDK communication and injects it with fake app installs, purchases, and clicks.

Not to fret, because there are many hard lessons learned from these fraud schemes, so let’s dig into a few ways you can prevent fraud today:

How to mitigate CTV ad fraud

1 – Set clear requirements with which inventory partners to work with. Work only with reliable CTV providers with transparent and accessible campaign measurement capabilities (such as pixel tracking)

2 – Work with a trusted MMP to ensure your data is accurate, fraudulent activity is flagged in real-time, and your users’ privacy is protected in full.

3 – Take a deeper look into your numbers, and ask the tough questions to uncover abnormal behavior patterns: Do these installs match the viewing habits in this geo or platform? Did users uninstall the app immediately after downloading it? Are there unusual app activity spikes that seem off to you?

CTV monetization strategy – Best practices

Now, let’s dive into how you can craft a strategy to measure the effectiveness of your CTV campaigns:

Step 1: Study your data

Gross Rating Points (GRP) is a widely accepted metric to measure the effectiveness of traditional TV advertising buys, where advertisers pay publishers based on their respective rating points for that ad.

That said, this is not a metric that fully harnesses the behavioral data of your CTV audience. So, here are a few ways you can measure the effectiveness of your campaign:

- Post-view website visit attribution: viewers visit your website after watching a CTV ad.

- Online purchase attribution: ad viewer made a purchase on your website or via CTV after watching an ad.

- Post-view conversions: viewers installed your mobile app and made a purchase on the app after seeing a CTV ad.

- Foot traffic attribution: omnichannel engagements and purchases following the view of an ad.

- Offline conversion tracking: measuring how many times an individual has watched an ad before a purchase is made.

- Brand lift / brand awareness: your market positioning, measured by how people are able to recall and engage with your brand after viewing a CTV ad.

Keep in mind that capturing data associated with these actions isn’t always simple, so finding a good measurement partner to do this for you — is key.

Step 2: Hone in on your audience

Harness the power of digital by identifying your most profitable audiences. A great place to start would be to utilize your current audience lists and build lookalike audiences. Then dive deeper into third-party data such as interests, demographics, devices, and geographic location.

The more granular you get, the more you can expand your reach to deliver relevant messaging to your viewers – and ultimately drive higher converting CTV campaigns.

Step 3: Measure, evaluate, iterate

The principles of a successful CTV campaign are the same for all other digital advertising campaigns. Ensure you’re always measuring, evaluating, and iterating, and take the audience insights and the data collected to continually optimize your campaigns.

To make sure you do this right, consider leveraging an MMP to help you resolve deduplication issues, flag ad fraud, and accurately measure your attribution.

Key takeaways

- OTT and CTV are not the same. Put simply, OTT content is viewed using CTV devices.

- In 2012, just 38% of American households owned a CTV device. Today in 2022, 87% of households own at least one CTV device.

- Investment in CTV advertising is booming due to its effective audiences and measurement capabilities on highly-engaged platforms.

- Finding transparent advertising partners and utilizing an MMP is the most effective way to combat ad fraud, and in turn, catapult your CTV advertising performance to the next level.